Scholarship for Hensley Colvin!

Hello friends,

Taxes are almost due, and if you didn't know already, Arizona allows you to choose how your taxes are used. You can allocate state income tax dollars to create scholarships for kids like ours in private schools at no cost to you. This is not a donation, but it's income taxes that we all have to pay anyhow.

You get 100% of it back as a credit; your Arizona taxes are reduced dollar-for-dollar when you contribute to a school tuition organization such as STO4KIDZ that turns the money into tuition aids to kids in private schools. This will have a huge impact on our ability to send Hensley to a great school!

For your convenience, here is a step-by-step guide to make a contribution and claiming your tax credits.

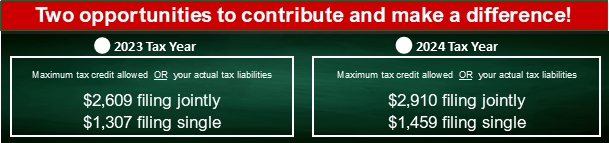

You can redirect your taxes and make a contribution and take the tax credit even if you plan to file for an extension, as long as you contribute through April 15th or the new IRS appointed date. STO4KIDZ directs your recommended contribution to Hensley Colvin and will email and/or mail you a tax receipt with detailed information on how to claim your tax credit. The State of Arizona provides a credit against your state taxes for 100% of your contribution up to the maximum amount allowed for the year, or your actual tax liability.

This is such a win/win for taxpayers and families with school-age children. We would be so grateful if you would consider supporting Hensley's private education in helping us lower her tuition.

We know this can be a bit overwhelming. Please watch a very short video below that explains this amazing program, and if you have any questions, please call us or STO4KIDZ staff at 602.698.8855.

Thank you so much,

Sara Snyder 480-390-2848