Individual Tuition Tax Credit

Your Personal Tax Credit Contribution Impacts the future of Arizona's Youth. Thank you so much!

The Arizona Private School Tuition Tax Credit Law A.R.S. 43-1089 permits you to redirect your state tax liabilities to School Tuition Organization 4 Kidz (STO4KIDZ) to create financial aids for K-12 students, and receive a dollar-for-dollar tax credit, all at No Net Cost.

How Individual Tuition Tax Credit Works?

Individual Tax Credit

Crédito de impuestos individual

The Arizona Private School Tuition Tax Credit Law A.R.S. 43-1089 permits you to redirect your state tax liabilities to School Tuition Organization 4 Kidz (STO4KIDZ) to create financial aid for K-12 students, and receive a dollar-for-dollar tax credit, all at NO Net Cost.

For financial aid eligibility and for tax filing purposes the contribution is categorize into two program:

- Individual Original

- Individual Switcher

For example, in 2023, individuals can claim up to $652 and married couples can claim up to $1,301 in "Switcher" credits, but only after contributing the maximum credit amount allowed for the "Original" Individual Income Tax Credit ($655 for individuals, $1,308 for joint filers in 2023).

- For more information about the Tuition Tax Credit Law please visit HERE.

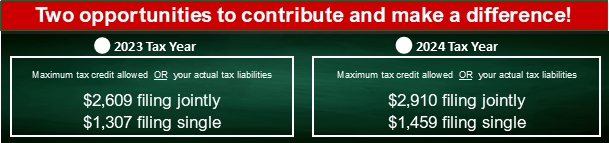

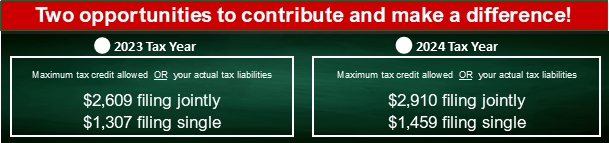

HOW MUCH CAN I CONTRIBUTE?

You can contribute up to the combined maximum of the Original ARS 43-1089 and the Switcher ARS 43-1089.03, or your actual Arizona tax liability, whichever is less, and receive a dollar-for-dollar Arizona state tax credit. If you have no liability, you cannot receive a dollar-for-dollar tax credit. For tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit).

HOW TO CONTRIBUTE:

1) Identity how much is your Arizona state tax. (If you receive a W2, check your last Pay-stub or your W2 slip for your state tax liabilities.)

2) Fill out the online or printable Individual donor form.

3) See chart below for total tax credit allowed for each year. Please note for tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit) which will be shown on your official tax receipt

- If your income tax is above the maximum amount allowed for filing jointly or filing singly, select the dollar amount for your filing status (married/jointly or single) on the contribution form.

- If your income tax is less than the maximum amount allowed for filing jointly or filing singly, then do the following, select "Other Amount" on the contribution form and type the total amount of your tax credit contribution, ONLY.

4) List your recommended student(s)/ school (optional) and complete your payment.

5) Once STO4KIDZ receives your payment, we will email or mail you an official receipt with instructions on how to claim your tax credit and the tax forms to se when filing your state taxes.

There are 5 different Individual Dollar-For-Dollar Tax Credit programs, and You CAN Give to Them All:

1) Private School Tax Credit: STO4KIDZ (This credit is claimed on forms 323 & 348)

2) Public and/or Charter School Tax Credit

- $400 - Filing Jointly/ Married

- $200 - Filing Single

(This credit is claimed on form 322) (List of links to all AZ public schools)

3) Qualifying Charitable Organizations (QCO)

- 2023: $841 married filing joint / $421 single, married filing separate or head of household.

- 2024: $938 married filing joint / $470 single, married filing separate or head of household.

We recommend H10 Ministries. Since March 2020, their joint efforts with STO4KIDZ have provided significant relief to many of our financial aid applicants affected by COVID and other hardships. List of qualifying charitable organizations provide by the Arizona Department of Revenue. (This credit is claimed on form 321)

4) Qualified Foster Care Charitable Organization (QFCO)

- $1,000 - Filing Jointly/ Married

- $500 - Filing Single

List of qualifying foster care organizations provide by the Arizona Department of Revenue. (This tax credit is claimed on form 352)

5) The Arizona Military Family Relief Fund Credit

- $800 - Filing Jointly/ Married

- $400 - Filing Single

Visit the Arizona Military Family Relief Fund website to contribute. You will have to mail a check with the printed form. This contribution must be made by December 31, and the fund can only accept a total of $1 million in contributions, so once that limit is reached, any more contributions received are returned.

Please consult your tax advisor for your eligibility.

STO4KIDZ accepts contributions throughout the year.

In order to claim the credit for the previous year's tax, make your contribution prior to filing for your taxes, but no later than April 15 or the IRS designated date, even if you plan to file for an extension. Your contribution must be postmarked or entered online by no later than midnight, April 15 or the IRS designated date.

2 Tax credit DEADLINES (December 31 and April 15, or the IRS designated date).

When filing your PERSONAL taxes, you can claim the tax credit by using Arizona forms 301 and 323 along with state income tax forms. However, if you contribute to the Switcher program as well, you need to file a 348 form. Using AZ Schedule A to claim the federal deduction is optional (Must consult your tax advisor).

- Form 301 (Tax Credit Summary) (Instruction)

- Form 323 (Individual Original Tax Credit) (Instruction)

- Form 348 (Individual Switcher Tax Credit) (Instruction)

- AZ form 140 (Personal income tax return) (Instruction)

All these forms and more can also be found at AZDOR.GOV.

Arizona tax credit programs for individuals are governed by statutes that permit donor recommendations. STO4KIDZ values and welcome donor recommendations in tuition aid awards. While the program regulations allow donor recommendations, it's important to understand certain rules associated with this giving scenario.

As defined by the State of Arizona, “A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of donor recommendation. A.R.S. 43-1603 (C). Any designation of your own dependent as a potential recipient is prohibited. Additionally, a taxpayer cannot claim a tax credit if they engage in a donation swap with another taxpayer to benefit their own dependent.

To secure your tax credit eligibility, please be aware of the following important rules:

- Prohibition on Parental Recommendations: Parents or guardians are not allowed to make a tax credit contribution recommending their own child. This rule also applies in divorce situations, even if the child is not claimed as a dependent.

- Strict Prohibition on Donation Swapping: Parents cannot engage in an arrangement with another parent (or parents) to recommend each other's students for contributions.

A minimum 90% of your contribution is used for scholarship award on a monthly basis.

Yes. STO4KIDZ is a tax-exempt charitable organization pursuant to federal law, Section 501(c)(3). Federal I.D. Number 82-4886421

An official tax receipt will be emailed to your provided email address. If you need a receipt immediately, please contact us at INFO@STO4KIDZ.ORG. We will gladly accommodate your request.

Thank you.

STO4KIDZ is a 501(c)(3) non-profit, charitable organization. You should consult your tax advisor for your specific tax question.

We sincerely welcome and appreciate your support and participation in this most worthwhile program at no out-of-pocket cost to you.