FREQUENTLY ASKED QUESTIONS

Individual Tax Credit - FAQ

The Arizona Private School Tuition Tax Credit Law A.R.S. 43-1089 permits you to redirect your state tax liabilities to School Tuition Organization 4 Kidz (STO4KIDZ) to create financial aid for K-12 students, and receive a dollar-for-dollar tax credit, all at NO Net Cost.

For financial aid eligibility and for tax filing purposes the contribution is categorize into two program:

- Individual Original

- Individual Switcher

For example, in 2023, individuals can claim up to $652 and married couples can claim up to $1,301 in "Switcher" credits, but only after contributing the maximum credit amount allowed for the "Original" Individual Income Tax Credit ($655 for individuals, $1,308 for joint filers in 2023).

- For more information about the Tuition Tax Credit Law please visit HERE.

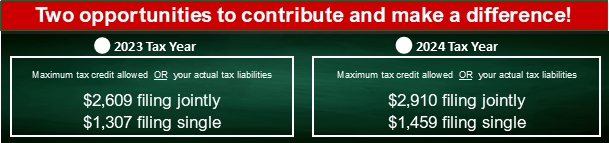

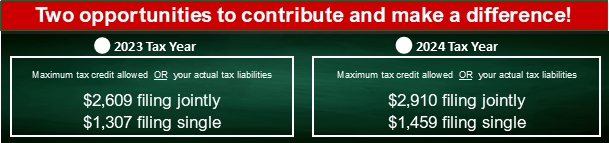

HOW MUCH CAN I CONTRIBUTE?

You can contribute up to the combined maximum of the Original ARS 43-1089 and the Switcher ARS 43-1089.03, or your actual Arizona tax liability, whichever is less, and receive a dollar-for-dollar Arizona state tax credit. If you have no liability, you cannot receive a dollar-for-dollar tax credit. For tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit).

HOW TO CONTRIBUTE:

1) Identity how much is your Arizona state tax. (If you receive a W2, check your last Pay-stub or your W2 slip for your state tax liabilities.)

2) Fill out the online or printable Individual donor form.

3) See chart below for total tax credit allowed for each year. Please note for tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit) which will be shown on your official tax receipt

- If your income tax is above the maximum amount allowed for filing jointly or filing singly, select the dollar amount for your filing status (married/jointly or single) on the contribution form.

- If your income tax is less than the maximum amount allowed for filing jointly or filing singly, then do the following, select "Other Amount" on the contribution form and type the total amount of your tax credit contribution, ONLY.

4) List your recommended student(s)/ school (optional) and complete your payment.

5) Once STO4KIDZ receives your payment, we will email or mail you an official receipt with instructions on how to claim your tax credit and the tax forms to se when filing your state taxes.

There are 5 different Individual Dollar-For-Dollar Tax Credit programs, and You CAN Give to Them All:

1) Private School Tax Credit: STO4KIDZ (This credit is claimed on forms 323 & 348)

2) Public and/or Charter School Tax Credit

- $400 - Filing Jointly/ Married

- $200 - Filing Single

(This credit is claimed on form 322) (List of links to all AZ public schools)

3) Qualifying Charitable Organizations (QCO)

- 2023: $841 married filing joint / $421 single, married filing separate or head of household.

- 2024: $938 married filing joint / $470 single, married filing separate or head of household.

We recommend H10 Ministries. Since March 2020, their joint efforts with STO4KIDZ have provided significant relief to many of our financial aid applicants affected by COVID and other hardships. List of qualifying charitable organizations provide by the Arizona Department of Revenue. (This credit is claimed on form 321)

4) Qualified Foster Care Charitable Organization (QFCO)

- $1,000 - Filing Jointly/ Married

- $500 - Filing Single

List of qualifying foster care organizations provide by the Arizona Department of Revenue. (This tax credit is claimed on form 352)

5) The Arizona Military Family Relief Fund Credit

- $800 - Filing Jointly/ Married

- $400 - Filing Single

Visit the Arizona Military Family Relief Fund website to contribute. You will have to mail a check with the printed form. This contribution must be made by December 31, and the fund can only accept a total of $1 million in contributions, so once that limit is reached, any more contributions received are returned.

Please consult your tax advisor for your eligibility.

STO4KIDZ accepts contributions throughout the year.

In order to claim the credit for the previous year's tax, make your contribution prior to filing for your taxes, but no later than April 15 or the IRS designated date, even if you plan to file for an extension. Your contribution must be postmarked or entered online by no later than midnight, April 15 or the IRS designated date.

2 Tax credit DEADLINES (December 31 and April 15, or the IRS designated date).

When filing your PERSONAL taxes, you can claim the tax credit by using Arizona forms 301 and 323 along with state income tax forms. However, if you contribute to the Switcher program as well, you need to file a 348 form. Using AZ Schedule A to claim the federal deduction is optional (Must consult your tax advisor).

- Form 301 (Tax Credit Summary) (Instruction)

- Form 323 (Individual Original Tax Credit) (Instruction)

- Form 348 (Individual Switcher Tax Credit) (Instruction)

- AZ form 140 (Personal income tax return) (Instruction)

All these forms and more can also be found at AZDOR.GOV.

Arizona tax credit programs for individuals are governed by statutes that permit donor recommendations. STO4KIDZ values and welcome donor recommendations in tuition aid awards. While the program regulations allow donor recommendations, it's important to understand certain rules associated with this giving scenario.

As defined by the State of Arizona, “A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of donor recommendation. A.R.S. 43-1603 (C). Any designation of your own dependent as a potential recipient is prohibited. Additionally, a taxpayer cannot claim a tax credit if they engage in a donation swap with another taxpayer to benefit their own dependent.

To secure your tax credit eligibility, please be aware of the following important rules:

- Prohibition on Parental Recommendations: Parents or guardians are not allowed to make a tax credit contribution recommending their own child. This rule also applies in divorce situations, even if the child is not claimed as a dependent.

- Strict Prohibition on Donation Swapping: Parents cannot engage in an arrangement with another parent (or parents) to recommend each other's students for contributions.

A minimum 90% of your contribution is used for scholarship award on a monthly basis.

Yes. STO4KIDZ is a tax-exempt charitable organization pursuant to federal law, Section 501(c)(3). Federal I.D. Number 82-4886421

An official tax receipt will be emailed to your provided email address. If you need a receipt immediately, please contact us at INFO@STO4KIDZ.ORG. We will gladly accommodate your request.

Thank you.

STO4KIDZ is a 501(c)(3) non-profit, charitable organization. You should consult your tax advisor for your specific tax question.

We sincerely welcome and appreciate your support and participation in this most worthwhile program at no out-of-pocket cost to you.

Corporate Tax Credit - FAQ

Invest in children at NO NET COST to you or your company!

The state of Arizona allows eligible businesses to allocate their tax liabilities and receive a dollar-for-dollar tax credit for up to 100% of their Arizona state tax liabilities. Simply redirect money that you would otherwise be paying in state income taxes and provide scholarships for Arizona K-12 students with verified finical needs. This is not a donation but a dollar-for-dollar tax credit. To participate, the company does not have to be based in Arizona, provided it pays Arizona tax liability. This is truly a Win-Win for you and Arizona students. Here you can fill out the form to participate.

Corporate Tax Credit History & Facts: (A.R.S.§20-224.06 and § 43-1183)

In 2006 and then in 2008, the Arizona State Legislature passed into law “The Corporate Income Tax Credit” and then the Disabled/Displaced Corporate Income Tax Credit, allowing businesses with an Arizona tax liability to allocate up to 100% of their tax liability and make a contribution to a qualified School Tuition Organization such as STO4KIDZ, and receive a dollar-for-dollar Tax Credit, may also qualify to claim that amount on their federal taxes as a donation.

Eligible Corporations:

- C- Corporations

- S- Corporations and LLC’s filing as an S-Corporation

- Insurance Companies that pay premium taxes in Arizona

- The company does not have to be based in Arizona, provided it pays Arizona tax liability.

Two Corporate Tax Credit Programs:

- Low-Income Corporate Tax Credit Program (A.R.S. § 43-1183)

- Disabled/Displaced Corporate Tax Credit Program (A.R.S. § 43-1184)

Who Will Benefit From The Corporate Tax Credit:

- K-12 students with a demonstrated financial need

- Preschool–12 students with disabilities

- Kindergarten students with demonstrated financial need

- Foster students

- US Armed Forces dependent

- Students transferring from a public or charter school with demonstrated financial need

- Students previously received Corporate or Switcher scholarships with demonstrated financial need

HOW TO PROCEED:

First:

1) Determine your business tax liability for the current year. You can allocate the total corporate tax liability amount.

2) Complete and submit your application by visiting STO4KIDZ.ORG or call for assistance at 480.823.8052.

Then:

1) STO4KIDZ will submit a Tax Credit Contribution Approval Request to the Arizona Department of Revenue (ADOR) on behalf of your company. (Applications must be submitted by an STO)

2) The request will be approved if the state cap has not yet been met. If the cap has been met, ADOR will create a waitlist based on the order in which the requests are received.

3) STO4KIDZ will notify you the same day ADOR informs us of the approval. Corporation has 20 calendar days to fund STO4KIDZ in order to keep the tax credit.

4) Once STO4KIDZ receives the contribution funds ADOR will be notified and STO4KIDZ will provide the company with a receipt to claim the tax credit.

5) When filing the company’s taxes, you will take the corporate income tax credit on the Standard 120 Form and file a 335 Form, listing the credit amount.

6) STO4KIDZ awards tuition scholarships to qualifying students.

- We are impacting our communities (Read more here)

- Immediate reduction in your corporate income taxes

- No out-of-pocket cost to you or your corporation.

- Can allocate up to 100% of your corporate state income tax liabilities.

- Receive a dollar-for-dollar tax credit.

- You may also qualify to claim your contribution on your federal taxes as a donation to STO4KIDZ, a 501c3 non-profit charitable organization.

- You benefit and aid K-12 students and schools in Arizona.

- Boost your community image as a corporate “good citizen”.

- Provide need-base financial aid to eligible K-12 Arizona private school students, and impact their future, today.

- STO4KIDZ in turn awards a minimum 90% of every dollar in tuition financial aid to eligible AZ private school students with verified financial needs within the same school calendar year.

(Please consult your tax advisor) http://www.azdor.gov/TaxCredits/CorporateTuitionTaxCredits.

- K-12 Students with a demonstrated financial need

- Pre-K–12 Students with Disabilities

- Kindergarten Students with a demonstrated financial need

- US Armed Forces Dependents

- Foster Children

- Students Transferring from a Public or Charter School with a demonstrated financial need

- Previous Corporate or Switcher Scholarship Recipients with a demonstrated financial need

Please Note:

STO Statuary guideline set in place by the Arizona Department of Revenue:

- Can a corporation direct its donation to the benefit of a particular student?

No. A corporation cannot direct its tax credit contribution to the benefit of a particulate student. However, corporation can recommend a private school, and STO4KIDZ will scholarship tuition aid to eligible student applicants from that school. - Can an S-corp or shareholder direct its donation for the benefit of a particular student?

No. In addition, a tax credit is not allowed if the S-corp or a shareholder, with the intent to benefit a shareholder’s dependent, agrees with one or more other taxpayers to designate reciprocal contributions to an

STO for the direct benefit of the other taxpayer’s dependent .

- C-Corporations

- S-Corporations & LLCs that file as an S-Corp

- Insurance Companies that pay premium taxes in Arizona

C-Corporations can allocate up to 100% of their state income tax liabilities for the given tax year as long as it does not exceed the statewide cap for the year. Credit can be carried forward for up to 5 years.

S-Corporations, (as defined in section 1361 of the Internal Revenue Code) can either claim the credit against income taxes at the corporate level (income tax reported on an Arizona 120S corporate income tax return) or it may make an irrevocable election to pass the credit through to its individual shareholders. The S-Corp must make a minimum aggregate contribution of $5,000 within their taxable year in order to pass the credit through to its shareholders and may allocate up to 100% of their state income tax liability for the given tax year, receive a dollar-for-dollar tax credit; then pass the credit on to its shareholders proportionately. If a corporation allocates more than their tax liability, it can be carried forward for up to 5 years. The contribution must be made by the S-corp, not a shareholder, in order to be eligible for the corporate tax credit. Each individual shareholder may claim only a pro-rata share of the credit based on the individual’s ownership interest in the S-corp. (A.R.S. § 43-1089.04).

LLCs that are taxed as S-corporations for federal and state purposes are eligible to contribute for tax credit.

Insurance companies that pay Arizona state tax liability on their premium income can allocate up to 100% of their premium tax liabilities.

- A credit is allowed against the premium tax liability incurred by an insurer pursuant to section 20-224, 20-837, 20-1010, 20-1060, or 20-1097.07 for the amount of voluntary cash contributions made by the insurer during the tax year to a school tuition organization.

- The amount of the credit is the total amount of the insurer’s contributions for the tax year under subsection A of this section that is pre-approved by the department of revenue pursuant to section 43-1183, subsection D.

(Use tax form 335 to claim your credit)

No. Corporations can only claim their contribution in the tax year in which the contribution is made (plus, five years for carry forward purposes). The law allows your corporation to allocate your tax liability to a School Tuition Organization (STO) such as STO4KIDZ, designating a private school, not a specific student. However, if there are not enough eligible students at your designated school, the money will be awarded among eligible students attending other qualifying private schools in Arizona.

When filing your CORPORATE taxes, you can claim your tax credit by using the Arizona tax form 335 or 355i. These forms and more can be found at AZDOR.GOV

- [Click here] to view and download tax forms needed to claim your credit.

- FACT-SHEET (an overview of the Corporate Tuition Tax Credit program)

STO4KIDZ awards a minimum of ninety percent of every contribution in scholarships to eligible Arizona K-12 students twice a year, at the beginning of each semester.

We sincerely welcome and appreciate your support and participation in this most worthwhile program.

Information below might be helpful:

** Every July, the state opens the window for corporate tax credit applications submitted by STOs on a specified date. Typically, the cap is reached within the first few minutes.

** If the state cap is not reached on the opening date in July, STO4KIDZ can continue submitting corporate tax credit applications for approval until the cap is reached by or before June 30th of the following year.

** As each company's tax filing year may differ, we recommend our donors consult with their tax advisors to confirm eligibility for the credit in their current tax year. Note that the tax credit can be carried over for up to 5 years.

First:

1) Determine your business tax liability for the current year. You can allocate the total corporate tax liability amount. To participate, the company does not have to be based in Arizona, provided it pays Arizona tax liability.

2) Complete and submit your non-binding contribution pledge form Online , or call Miriam at 480.823.8052 for assistance.

Then:

1) STO4KIDZ will submit a Tax Credit Contribution Pre-approval Request on behalf of your company to the Arizona Department of Revenue (ADOR).

2) The request will be approved if the state cap has not yet been met. If the cap has been met, ADOR will create a waitlist based on the order the requests are received.

3) STO4KIDZ will notify you the same day ADOR inform us of the approval. Corporation has 20 calendar days to fund STO4KIDZ in order to keep the tax credit.

4) Once STO4KIDZ receives the contribution funds ADOR will be notified and STO4KIDZ will provide the company a receipt to claim the tax credit.

5) When filing the company’s taxes, you will take the corporate income tax credit on the Standard 120 Form and file a 335 Form, listing the credit amount (335-I / Instruction or 335/ Instruction.) For additional information select here.

6) STO4KIDZ awards tuition scholarships to qualifying students.

If you have questions, please contact Miriam Antolik at 480.823.8052 - 602.698.8855 OR Email us.

We sincerely welcome and appreciate your support and participation in this most worthwhile program at no out-of-pocket cost to you.

Student Applicant- FAQ

We aspire to provide School Choice available to Arizona families.

STO4KIDZ is a School Tuition Organization (STO) which falls under Section 501(c)(3) of the Internal Revenue Code. We are also certified by the Arizona Department of Revenue (ADOR) and is in compliance with the Private School Tuition Tax Credit Requirements.

We provide tuition financial aid and scholarships to qualified Arizona private school students by utilizing the Arizona tuition tax credit contributions made by generous Individuals and Corporations who would like to redirect their state tax liabilities towards private education and invest in future leaders to positively impact their communities.

Every K-12 student can be recommended by individual donors. Corporations have the option to recommend one or more private schools.

A Minimum 90% of every dollar is awarded in form of tuition aid and scholarships.

Please visit our About Us. or call us at 602.698.8855. We would love to hear from you.

Yes. A current complete application is required each academic year for STO4KIDZ STO awards consideration. The application expires at the end of each school year, necessitating annual renewal.

Note: Kindergarten students must be 5 years old by January 1st to qualify for a STO financial Aid.

You must apply for each student once per school year. The application is good for each academic year and it expires in May of each year.

Online application windows for each academic year are:

- April 18th – June 1st OR

- November 1st – December 1st

- See our "Applicant Checklist" to prepare your documents prior to starting application process.

Register your child If your child is enrolling in a private school for the 2024-25 or 2025-26 school year, now's the ideal time to plan ahead. For more details, click this helpful link on New Student Information."

Please visit our "Applicants Home Page" for detail.

Online Application can be submitted ONLY between April 18th - June 1st, OR November 1st - December 1st each year. Incomplete application will not be reviewed for tuition aid award.

- One application per student, per school year only.

- Do not submit multiple applications for the same student.

- Each application is reviewed for eligibility for ALL four award types available (Individual Original, Switcher, Corporate Low Income, and Corporate Disabled/Displaced.)

** NOTE: Applications must be renewed and submitted each year (between April 18th -June 1st OR November 1st - December 1st)

REQUIRED Documents for those who DO file taxes:

- The first two pages of the previous year’s Federal Tax Return Form (see example 1040 pages 1 and 2).

(e.g. If you are applying for the 2023/24 school year, upload your 2022 tax document) - If self-employed, ALSO upload Schedule C (sample), and Schedule E (sample).

(uploaded form must not require a password to view) - If you filed an extension, please include a copy of your IRS extension paperwork. You will have until October 15 to email your taxes to Info@sto4kidz.org. (Your student's application is considered incomplete until then)

- If your student is NEW to Private School, or has attended an Arizona private school in the prior year. MUST ALSO upload the applicable supporting document to be eligible for the Switcher and/or Corporate tuition awards (View potentially needed documents listed here)

ALTERNATIVE REQUIRED Documents for those who DO NOT file taxes:

- View, complete and upload the required supplemental financial documentation.

- If your student is NEW to Private School, or has attended an Arizona private school in the prior year. MUST ALSO upload the applicable supporting document to be eligible for the Switcher and/or Corporate tuition awards. (View potentially needed documents listed here)

How to create your application portal tutorial (Click here)

All students can be recommended by donors for the Individual Original Tax Credit.

STO4KIDZ awards a minimum 90% of every tax credit contribution and charitable donation in scholarship, MONTHLY.

Basis for awarding tuition aid awards (all programs):

- A complete annual application, with all documents to determine eligibility)

- Donor recommendation

- Family financial circumstances

- A brief narrative about the student by parent/guardian

- Letters of recommendation for the student

- Students with disabilities: Pre-school -12 grades (IEP/MET documents)

- Displaced students/ Foster child (Require supporting documents)

- STO4KIDZ does not discriminate based on race, color, belief, or gender.

NOTE: A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. A.R.S. 43-1603 (C). Any designation of your own dependent as a potential recipient is prohibited.

STO Tuition financial aid are made possible through the Individuals donors and Corporate donors who chose to redirect their state income taxes toward private education tuition at no-cost to them.

Participants receive a dollar-for-dollar credit therefore, lowering their income tax liabilities which we all liable to pay anyhow.

Since the state wont allow parents to redirect their taxes towards their own child, we encourage our applicants to also be a donor. Contribute your taxes to STO4KIDZ to help another family lower their child's tuition. general scholarship fund.

There are four STO award types:

- Individual Original (All students are eligible)

- Individual Switcher

- Corporate Low-Income (LI)

- Corporate Disabled/Displaced (DD)

Prerequisites for the Individual Switcher and the Corporate Tuition Financial Aid Awards:

NOTE: To be eligible for the Corporate LI, family must also meet the annual state income cap guideline.

- Preschoolers with an Arizona public school IEP or MET are also eligible.

- Kindergarten Student (All students entering Kindergarten at a private school are eligible)

- US Armed Forces Dependent (Must provide copy of military orders showing Arizona duty stations)

- Transferring from a Public or Charter School - Date Transferred (Must have attended the public/charter school for at least 90-days prior to full-time enrollment at a private school. This "Attendance Verification form" much be completed by the school admin)

- Previously Received Corporate, Original or Switcher/Overflow Scholarship (Must provide "Previous STO Award Verification form" - to be completed by the administration)

- Child with disability (Must provide a copy of an Arizona public school IEP or MET and Information Release form )

- Foster/Displaced Student (Must provide DCS verification and Information Release form (complete "This Verification form" and upload with application)

- Past ESA Recipient - Student participated in the (ESA) program and did not renew the account or accept the scholarship in order to accept STO scholarship. (Must complete the “Student Transfer form” AND provide a copy of a letter from the ESA stating your account is closed)

- Transferred from Out of State, or Home-schooled (Must provide "Student Transfer Verification form" and applicable documentation)

Pending funds availability, financial aids are awarded as listed below:

- Individual Original & Switcher & Charitable donations: Monthly award (August 31st - April 30th)

- Corporate Low-Income (LI) & Disabled/Displaced (DD): Twice a year awards (September & January.

- If your student has Individual donor recommended funds and a complete current school year STO4KIDZ application on file, awards are released monthly from August to April of each academic year, with checks sent to school at the end of each month.

- If student has an active ESA account, or or has zero tuition balance their STO recommend funds will be held in his/her "STO4KIDZ Multi-Year account" for the following school year (See ESA vs. STO funding for detail)

- Corporate Low-Income (LI) financial aids is based on household income and size. Award are disbursed in September and January at the semester's start, pending fund availability. A complete STO4KIDZ application for the current school year is required.

- Corporate Disabled/Displaced (DD) financial aids are disbursed in September and January at the semester's start, subject to fund availability. A complete STO4KIDZ application for the current school year is required.

- Each time your student receives an award from STO4KIDZ, after the tuition award check has been sent to their school an award letter will be emailed to the primary email address listed on the application form.

Please contact us if you are not sure your student qualifies to receive the Switcher Tax Credit or the Corporate financial aid awards.

Yes. A current and complete application is required each academic year for STO4KIDZ tuition aid award(s) consideration. The application expires at the end of each school year, necessitating annual renewal. While we value tax contributor recommendations, they alone do not guarantee tuition aid; STO4KIDZ considers various factors when awarding. Nevertheless, we strive to meet every student's tuition needs to the best of our ability.

Yes. Please carefully read guidelines below for each category.

- For student who recently moved to Arizona:

“Out of state” refers to both US and international students.

To meet the out of state prerequisite for the "Switcher" tuition award the student must enroll directly into a qualified Arizona private school. However, there is no requirement for the student to be previously enrolled in an out of state public school, private school or homeschool.

If they enroll in an Arizona public school or choose to homeschool in Arizona before attending a qualified private school, the student does not meet the out of state prerequisite Switcher awards, but can be eligible for the "Original, Corporate Low-Income (LI) or Disabled/Displaced (DD) awards.

For verification, we require a copy of the student’s school enrollment/withdrawal from the previous out of state school.

- For Previously Homeschooled Students:

The student must have been homeschooled prior to enrolling in a qualified private school.

Students who complete a school year through homeschooling will be eligible for the "Switcher" tuition award for the upcoming academic year. Additionally, students who switch directly from homeschooling to an eligible private school within the same academic year are also eligible for the same award.

If a student enrolls in public school between homeschool and private school, they do not meet the homeschool prerequisite. For verification, we require a copy of the student’s applicable county homeschool withdrawal form/discontinuation form.

Still have questions? Please contact us.

Regrettably, STO4KIDZ is obligated by state law to grant tuition aid awards exclusively for the present year's tuition.

Still have questions? Please contact us.

STO4KIDZ can cover the costs of summer school exclusively for high school students, specifically for credit-bearing classes required for graduation, Pending funds availability.

Still have questions? Please contact us.

Yes. We can grant financial aid to a student if repeating a grade.

The state statuary guideline permits students to receive awards from multiple STOs simultaneously. While some STOs may have policies limiting concurrent awards, STO4KIDZ does not impose such restrictions and allows students to receive funds from multiple sources.

STO tuition aid funds always follow the student.

Your school is required to reimburse STO4KIDZ with a proportional portion of the the financial aid award.

- If the student switches to another private school in Arizona, the unused STO funds will be transferred to the new school.

- If the student transfers to a public or charter school, or opts for homeschooling, STO4KIDZ will reallocate those funds to support another deserving student at your school.

- Can a student who is receiving Empowerment Scholarship Account (ESA) money from the Arizona Department of Education also receive funds from an STO?

No. Pursuant to A.R.S. §15-2402(B)(3), an ESA account holder agrees to not receive any STO scholarships in the same contract year as an ESA. The ESA contract year is July 1st through June 30th. Once there is a signed ESA contract, all STO monies that have been remitted to a private school for the same contract year must be returned to the STO regardless of when the ESA contract was signed or when the STO remitted scholarship money to a private school for the same academic year.

- Utilizing ESA Account while seeking recommended contributions for future academic years tuition through Multi-Year STO4KIDZ fund:

You have the opportunity to request Recommended Fund contributions while your student is enrolled in ESA. Upon submitting your ESA contract cancellation documents to STO4KIDZ, any MULTI-YEAR award your child receives can be directed to your private school. This strategy enables you to gather funds for upcoming higher tuition expenses, like high school. (An annual submission of a comprehensive STO4KIDZ application is required) (Must submit a STO4KIDZ application annually)

- Students who opted for STO awards instead of renewing or accepting ESA scholarships:

Students who received an ESA in the prior academic year and chose not to renew their ESA account for the following school year, or students who did not accept their ESA scholarship in the current academic year are eligible to receive STO awards. We require a closed ESA account letter. If a student left private school after closing their ESA account to attend an Arizona public school or home-school, they are not eligible for STO awards.

- What if a parent ends the ESA contract during the school year? Can the student then receive an STO tuition aid award?

If the parent closes the ESA contract during the school year there will be no conflict for the student to receive STO tuition aid award for the remainder of the academic year after the ESA contract was cancelled. Parents that withdraw from the ESA program will receive an email indicating their ESA account is closed which can be provided to STO4KIDZ for verification.

STO4KIDZ can NOT make any tuition aid award for the period in which ESA money was received. STO funding may begin the quarter following the ESA contract cancellation. For example, if the ESA contract is cancelled in November (Quarter 2) an STO tuition aid can be awarded beginning in January (Quarter 3) to cover Quarters 3 and 4. If a parent cancels their ESA contract prior to receiving and/or spending any ESA funding, an STO4KIDZ can award tuition aid for the same quarter(s) only if the parents can provide documentation that no money was received and/or spent. Please note that parents will not be eligible to sign another ESA contract until July 1 of the next contract year.

- How does STO4KIDZ determine if our financial aid applicants are receiving ESA money?

STO4KIDZ financial aid application form and payment process includes verification with the private schools and the parents that students financial aid applicants do not have a signed contract or have not received any ESA funding for the current school year. If we determine that the parent has a signed ESA contract, the private school must refund all STO financial aid money paid for the same contract year back to our STO. STO4KIDZ requires verification from the private schools and the parents throughout the academic year as a student’s ESA status can change during the year.

ADDITIONAL RESOURCES:

- Arizona Department of Education AZED.GOV/ESA

- American Federation for Children: www.azesa.org Email: Arizona @federationforchildren.org ESA application tutorial Phone: 623.254.4717 (Respond within 24 hours)

- Love Your School: www.loveyourschool.org Email: hello@loveyourschool.org Phone: 480.612.8784 (Respond within 24 hours)

- Educational Services Alliance: www.esaconnection.com Email: Chris Holmberg at chris@esaconnection.com Phone: 623.203.7207

School - FAQ

What is a qualified private school? (A.R.S. § 43-1089)

- Qualified school means a preschool that offers services to students with disabilities, nongovernmental primary or secondary school that is in Arizona and that does not discriminate based on race, color, disability, familial status, or national origin.

- Qualified school does not include a charter school, or any program operated by a charter school. This means that a private school program which operates in the same facilities as the charter school operates and a private school program that is administered by the same staff as employed by a charter school is not eligible for private school tuition organization scholarships.

- All teaching staff and personnel that have unsupervised contact with students are required to be fingerprinted.

What if, after reading the definition of a qualified school, I’m still unsure if the school is qualified?

- STO4KIDZ can request a determination as to whether a private school is a qualified school by emailing the STO division of the Arizona Department of Revenue. Please be prepared to provide all information available about the school in question as the determination will be based on the information you provide.

Are online private schools considered qualified schools?

- The school must be located in Arizona, including online schools. Full-time enrollment is necessary in the private online school, which must provide instruction, classes, grades, credits, and promotions directly, not through third-party correspondence programs. Eligibility for an STO scholarship requires Arizona residency for online private school students. Online private schools should meet state requirements for full-time enrollment, which involves providing instruction for the same number of days and hours as public schools as per A.R.S. § 15-802(G)(3) and 180 days or prescribed instructional hours for kindergarten through twelfth grade as per A.R.S. § 15-901.

Are hybrid (teacher-parent integrated instructional approach) private schools considered qualified schools?

- With regards to full-time enrollment, the hybrid model should satisfy the requirements prescribed by law for private schools.

We aim to offer School Choice in Arizona by partnering with private schools to provide tuition tax credit financial aids to their students and collaborate with school administrators to benefit students and schools.

What we expect of our partner schools

- Complete an annual school application/ Agreement. (online partnership)

- Acknowledge our partnership, which could include adding us to your website's list of STOs.

- Extend invitations to us for events like open houses, tuition nights, and family-related activities.

- Include us in your mailing list to help us stay connected with your community.

- Follow and like us on Facebook and Instagram

To maintain current school data, which encompasses tuition details, staff alterations, and updated contact information, our partner schools are required to submit an annual agreement / application between April 18 and June 1 every year.

Student Online Application Timeline:

- April 18th - June 1st for the upcoming school year

For new students or those who missed the 1st application window:

- November 1st – December 1st

Application Guideline:

- One application per student, per school year only.

- Do not submit multiple applications for the same student.

- Each application is reviewed for eligibility for ALL four award types available (Individual Original, Switcher, Corporate Low Income, and Corporate Disabled/Displaced)

- Applications must be renewed and submitted each year (between April 18th -June 1st.

(For Details, Please See Our Applicant Checklist )

Where does STO tuition aid come from?

STO Tuition financial aid are made possible through the Individuals donors and Corporate donors who chose to redirect their state income taxes toward private education tuition at no-cost to them. Participants receive a dollar-for-dollar credit therefore, lowering their income tax liabilities which we all liable to pay anyhow.

There are 4 STO award types:

- Individual Original, and Switcher awards, All students can be eligible for the Individual Original award.

- Corporate Low-Income (LI), and Disabled/Displaced (DD) awards.

- There are prerequisite requirements for the Switcher and Corporate award eligibility.

- To be eligible for the Corporate LI, family must also meet the state income cap guideline)

For Out of State Student:

“Out of state” refers to both US and international students.

To meet the out of state prerequisite for the "Switcher" tuition award the student must enroll directly into a qualified private school. However, there is no requirement for the student to be previously enrolled in an out of state public school, private school or homeschool.

If they enroll in an Arizona public school or choose to homeschool in Arizona before attending a qualified private school, the student does not meet the out of state prerequisite Switcher awards, but can be eligible for the "Original, Corporate Low-Income (LI) or Disabled/Displaced (DD) awards.

For verification, we require a copy of the student’s school enrollment/withdrawal from the previous out of state school.

For Previously Homeschooled Students:

The student must have been homeschooled prior to enrolling in a qualified private school.

Students who complete a school year through homeschooling will be eligible for the "Switcher" tuition award for the upcoming academic year. Additionally, students who switch directly from homeschooling to an eligible private school within the same academic year are also eligible for the same award.

If a student enrolls in public school between homeschool and private school, they do not meet the homeschool prerequisite. For verification, we require a copy of the student’s applicable county homeschool withdrawal form/discontinuation form.

Still have questions? Please contact us.

There are four STO award types:

- Individual Original (All students are eligible)

- Individual Switcher

- Corporate Low-Income (LI)

- Corporate Disabled/Displaced (DD)

Prerequisites for the Individual Switcher and the Corporate Tuition Financial Aid Awards:

NOTE: To be eligible for the Corporate LI, family must also meet the annual state income cap guideline.

- Preschoolers with an Arizona public school IEP or MET are also eligible.

- Kindergarten Student (All students entering Kindergarten at a private school are eligible)

- US Armed Forces Dependent (Must provide copy of military orders showing Arizona duty stations)

- Transferring from a Public or Charter School - Date Transferred (Must have attended the public/charter school for at least 90-days prior to full-time enrollment at a private school. This "Attendance Verification form" much be completed by the school admin)

- Previously Received Corporate, Original or Switcher/Overflow Scholarship (Must provide "Previous STO Award Verification form" - to be completed by the administration)

- Child with disability (Must provide a copy of an Arizona public school IEP or MET and Information Release form )

- Foster/Displaced Student (Must provide DCS verification and Information Release form (complete "This Verification form" and upload with application)

- Past ESA Recipient - Student participated in the (ESA) program and did not renew the account or accept the scholarship in order to accept STO scholarship. (Must complete the “Student Transfer form” AND provide a copy of a letter from the ESA stating your account is closed)

- Transferred from Out of State, or Home-schooled (Must provide "Student Transfer Verification form" and applicable documentation)

Basis for awarding tuition aid awards (all programs):

- Family financial circumstances

- A brief narrative about the student by parent/guardian

- Letters of recommendation for the student (considering student’s age)

- Students with disabilities: Pre-school -12 grades (Must provide supporting documents)

- Displaced students/ Foster child (must provide supporting documents)

- Donor recommendation (pending student’s eligibility and tuition aid need)

- STO4KIDZ does not discriminate based on race, color, belief, or gender.

NOTE: A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. A.R.S. 43-1603 (C). Any designation of your own dependent as a potential recipient is prohibited.

Can STO4KIDZ work with the school in awarding scholarships?

- STO4KIDZ has the sole responsibility for STO awards, and statutory requirements apply to STOs, not schools. Schools can recommend students for scholarships, but the criteria and selection is determined by STO4KIDZ.

STO4KIDZ Awards Timeline:

Funds are awarded annually during August through the final week of April.

- Individual Original & Switcher (Donor recommended & General Fund): Monthly

- Corporate Low-Income (LI) & Disabled/Displaced (DD): Twice a year (September & January, pending funds availability for your school.)

Student with Individual Donor Recommended Funds:

- Starting in August, donor recommended funds received by the 15th of each month for students with current and complete STO4KIDZ application, will be reviewed and awarded by month-end.

- If the student is fully funded/ OR not yet enrolled during the current school year, recommended funds will be held in their "MULTI-YEAR" tuition account with STO4KIDZ for future school year awards.

- Parents/guardians must apply during our 1st application window (April 18 - June 1) for the upcoming school year in order for funds to be awarded for the subsequent school year.

School Individual & Corporate Donor Recommended Funds:

- Starting in August of each academic year, funds received by the 15th of each month for students attending donor-selected school(s) will undergo review for awards to their students with current and complete STO4KIDZ applications and will be funded the same month.

- Any unused STO funds from Individual and Corporate donors, designated for specific schools, will be retained in the school(s) "MULTI-YEAR" tuition account with STO4KIDZ to be used for future school year awards.

Corporate Low-Income (LI) & Disabled/Displaced (DD)

- In September and January of each academic year, eligible students with a complete application will undergo review for the corporate scholarship awards pending funds availability for your school.

Please contact us with any questions.

Regrettably, STO4KIDZ is obligated by state law to grant scholarships exclusively for the present year's tuition.

STO4KIDZ can cover the costs of summer school exclusively for high school students, specifically for credit-bearing classes required for graduation. Pending funds availability.

Yes. We can grant financial aid to a student if repeating a grade.

The school must refund STO4KIDZ any excess amount beyond the student's annual tuition. If the award is an Individual Original or Switcher, funds will roll-over to the following school year for the family account. Parent/ guardian must submit a complete application for the upcoming school year in order for us to release the fund towards the subsequent school year's tuition.

The state statuary guideline permits students to receive awards from multiple STOs simultaneously. While some STOs may have policies limiting concurrent awards, STO4KIDZ does not impose such restrictions and allows students to receive funds from multiple sources.

Your school is required to reimburse STO4KIDZ with a proportional portion of the the financial aid award.

- If the student switches to another private school in Arizona, your school must refund STO4KIDZ the unused award money then we will send the funds to the new school.

- If the student transfers to a public or charter school, or opts for homeschooling, your school must refund STO4KIDZ the unused portion of the award, which in turn we will reallocate those funds to support another deserving student at your school.

- If the student is expelled for disciplinary reasons during the school year with unused STO funds, your school must refund STO4KIDZ the unused portion of the award, which in turn we will reallocate those funds to support another deserving student at your school.

- Can a student who is receiving Empowerment Scholarship Account (ESA) money from the Arizona Department of Education also receive funds from an STO?

No. Pursuant to A.R.S. §15-2402(B)(3), an ESA account holder agrees to not receive any STO scholarships in the same contract year as an ESA. The ESA contract year is July 1st through June 30th. Once there is a signed ESA contract, all STO monies that have been remitted to a private school for the same contract year must be returned to the STO regardless of when the ESA contract was signed or when the STO remitted scholarship money to a private school for the same academic year.

- Utilizing ESA Account while seeking recommended contributions for future academic years tuition through Multi-Year STO4KIDZ fund:

You have the opportunity to request Recommended Fund contributions while your student is enrolled in ESA. Upon submitting your ESA contract cancellation documents to STO4KIDZ, any MULTI-YEAR award your child receives can be directed to your private school. This strategy enables you to gather funds for upcoming higher tuition expenses, like high school. (An annual submission of a comprehensive STO4KIDZ application is required) (Must submit a STO4KIDZ application annually)

- Students who opted for STO awards instead of renewing or accepting ESA scholarships:

Students who received an ESA in the prior academic year and chose not to renew their ESA account for the following school year, or students who did not accept their ESA scholarship in the current academic year are eligible to receive STO awards. We require a closed ESA account letter. If a student left private school after closing their ESA account to attend an Arizona public school or home-school, they are not eligible for STO awards.

- What if a parent ends the ESA contract during the school year? Can the student then receive an STO tuition aid award?

If the parent closes the ESA contract during the school year there will be no conflict for the student to receive STO tuition aid award for the remainder of the academic year after the ESA contract was cancelled. Parents that withdraw from the ESA program will receive an email indicating their ESA account is closed which can be provided to STO4KIDZ for verification.

STO4KIDZ can NOT make any tuition aid award for the period in which ESA money was received. STO funding may begin the quarter following the ESA contract cancellation. For example, if the ESA contract is cancelled in November (Quarter 2) an STO tuition aid can be awarded beginning in January (Quarter 3) to cover Quarters 3 and 4. If a parent cancels their ESA contract prior to receiving and/or spending any ESA funding, an STO4KIDZ can award tuition aid for the same quarter(s) only if the parents can provide documentation that no money was received and/or spent. Please note that parents will not be eligible to sign another ESA contract until July 1 of the next contract year.

- How does STO4KIDZ determine if our financial aid applicants are receiving ESA money?

STO4KIDZ financial aid application form and payment process includes verification with the private schools and the parents that students financial aid applicants do not have a signed contract or have not received any ESA funding for the current school year. If we determine that the parent has a signed ESA contract, the private school must refund all STO financial aid money paid for the same contract year back to our STO. STO4KIDZ requires verification from the private schools and the parents throughout the academic year as a student’s ESA status can change during the year.

For information on ESA you can visit AZED.GOV/ESA OR contact us.