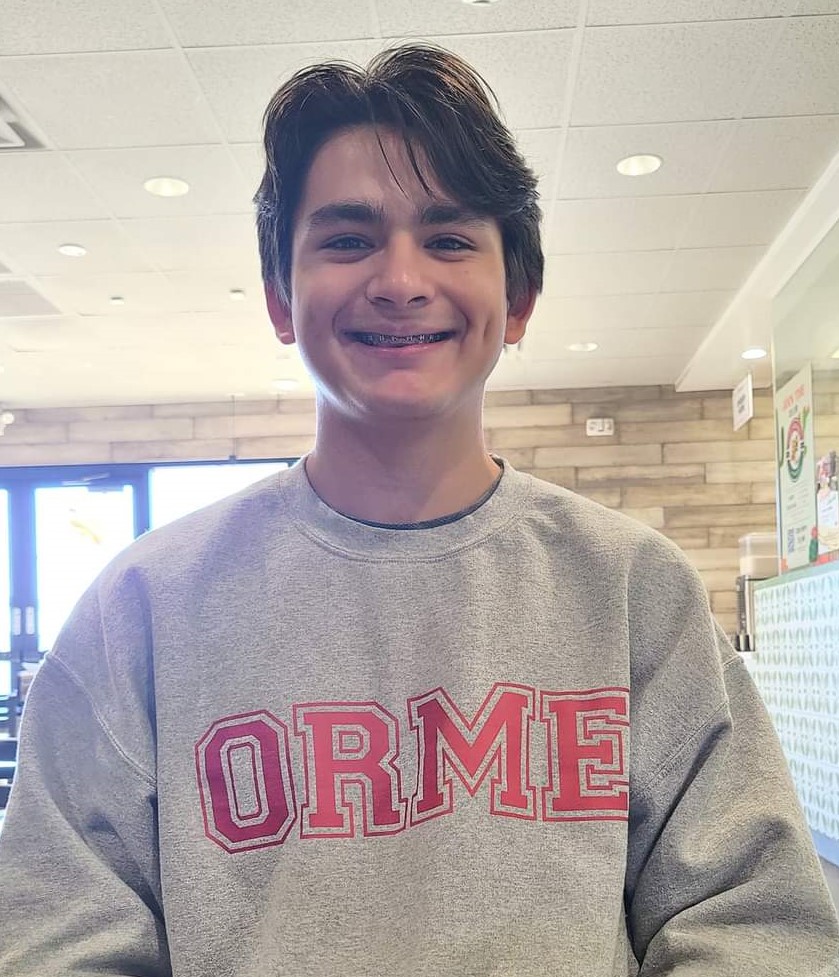

Scholarship for Chris Lim!

Dear friends,

I am truly grateful for the opportunity to enroll Chris at The Orme School he is flourishing in every way you can imagine!

Chris, began attending The The Orme School School in Mayor, Arizona, in August 2023, and I'm delighted to report his remarkable progress. After struggling academically and emotionally during his freshman and sophomore years at our local high school, he needed a change. Since enrolling at The Orme School, his grades have soared to A's and B's, earning him a spot on the honor roll. He's developed independence, leadership, and communication skills, and his confidence has flourished.

If you didn't know, Arizona gives you the choice on how your taxes are used. You can allocate state income tax dollars to create scholarships for kids like Chris in private schools at no cost to you. This is not a donation, but it's income taxes that we all have to pay anyhow.

You get 100% of it back as a credit; your Arizona tax liability is reduced dollar-for-dollar when you contribute to a school tuition organization like STO4KIDZ. This will have a huge impact on my ability to send Chris to this great school. and would be so grateful if you consider redirection a portion of your taxes to help lower his tuition!

2023 Tax Year

2024 Tax Year

The net cost to you is ZERO, but the benefit to Chris is PRICELESS! Everyone really wins! Your Arizona tax liability is reduced dollar-for-dollar when you contribute to a school tuition organization such as STO4KIDZ as long as you contribute by April 15 of each year, (or the designated date set by IRS).

For your convenience, here is a [step-by-step guide], and when ready, please click [here] to make your contribution and recommend Chris Lim at the Orme School. STO4KIDZ will email you a receipt for your taxes with instruction on how to claim your dollar-for-dollar tax credit.

Also, if you're a non-Arizona resident and/or you'd like to make a charitable donation to help lower their tuition, you can donate [here] Your donation is 100% tax-deductible as STO4KIDZ is a 501(c)3, non-profit charitable organization.

Please take a couple of minutes to watch a short video at the end of this page which explains how the AZ tax credit works, and contact STO4KIDZ staff with any questions.

We appreciate you wholeheartedly!

Pamela Lim

STO4KIDZ - 602.698.8855