Scholarship for Kaylen Mosley!

Hello friends,

As many of you know Kaylen started Kindergarten at the age of 4 years old after testing in to start school early. Since then Kaylen has maintained A’s and B’s and was voted as her school's student council president last year. She is now 13 years old and in the 8th grade. In Early February 2023, Kaylen was accepted into Xavier College Preparatory High school. We are very excited about this opportunity. Kaylen’s hobbies and interests are playing volleyball, reading, and dancing. Her goal and aspiration for her future are to become a surgeon.

In search of ways to lower Kaylen's tuition, we have learned more about the Arizona Tax Credits which allows its taxpayers to redirect a portion of taxes towards private education all at No cost to participants. We hope you consider supporting Kaylen to help us lower her tuition fee.

In search of ways to lower Kaylen's tuition, we have learned more about the Arizona Tax Credits which allows its taxpayers to redirect a portion of taxes towards private education all at No cost to participants. We hope you consider supporting Kaylen to help us lower her tuition fee.

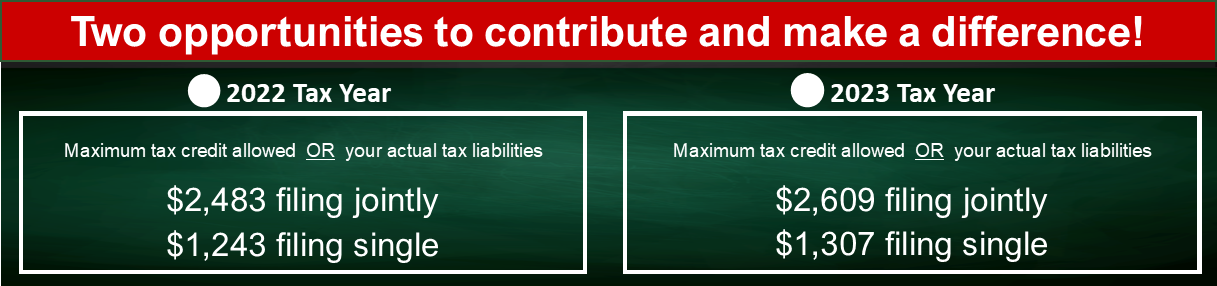

Here is how it works: You are able to redirect the taxes you are already liable for by making a contribution to a school tuition organization like STO4KIDZ. This is not a donation. You get 100% of your contribution back as a credit: your Arizona tax liability is reduced dollar-for-dollar. Please feel free to watch the video at the end of the page which explains how this works. Here is the step-by-step how to contribute. The net cost to you is ZERO, but the benefit to our family is PRICELESS!

We greatly appreciate your consideration. Here you can contribute online, even if you plan to file for an extension as long as you contribute until April 18, 2023, even if you plan to file for an extension, you can take the tax credit. When making your contribution, please recommend Kaylen Mosley, and select Xavier College Preparatory. STO4KIDZ will email you a receipt for your taxes.

Please take a moment to watch a short video that explains how this works and, if you have any questions, please call either us, or you can speak directly with the very helpful staff at STO4KIDZ (602-698-8855).

Thank you so much,

Debbie Thomas and family ( 602) 717-7440