Redirect Your Arizona Taxes for Scholarship to Empower our Future Leaders

Take the dollar-for-dollar tax credit and make a difference!

When we invest in our young leaders, we are investing in the growth of our society. Providing them with the support and resources they need to succeed ensures that the next generation of leaders is prepared to tackle the challenges of the future and make a positive impact on the world.

Tax Benefits That Make a Difference!

Immediate tax savings at no-out-of-pocket costs to donors!

Support our mission of provideing tuition assistance to K-12 students, enabling them to access the educational environment that aligns with their unique needs through the Arizona tax credit program.

Redirect Your Arizona Tax Liabilits for K-12 Private Education Scholarships at No Net Cost!

Individuals

2023 Tax Year Cap

Filing Jointly

$2,609

Filing Single

$1,307

2024 Tax Year Cap

Filing Jointly

$2,910

Filing Single

$1,459

Maximum tax credit allowed or your actual tax liabilities.

Corporations

Low Income Gap

$158,476,605

Disabled/Displaced Cap

$6,000,000

Allocate up to 100% of your corporate state income tax liabilities

Take a Dollar-For-Dollar Tax Credit

One application per school year covers all 4 types of STO tuition aid awards

One application per school year is sufficient for all 4 types of STO awards we offer to students.

Invest In The Future, Today!

Discover how to participate at no extra cost by watching the informative videos below. We strongly believe that every student deserves the opportunity to enroll or remain in their ideal private school that best suits their needs.

We’re here to help

Browse our most frequently asked questions.

STO4KIDZ accepts contributions throughout the year. Contributions must be made prior to filing your taxes but no later than April 15.

HOW MUCH CAN I CONTRIBUTE?

You can contribute up to the combined maximum of the Original ARS 43-1089 and the Switcher ARS 43-1089.03, or your actual Arizona tax liability, whichever is less, and receive a dollar-for-dollar Arizona state tax credit. If you have no liability, you cannot receive a dollar-for-dollar tax credit. For tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit).

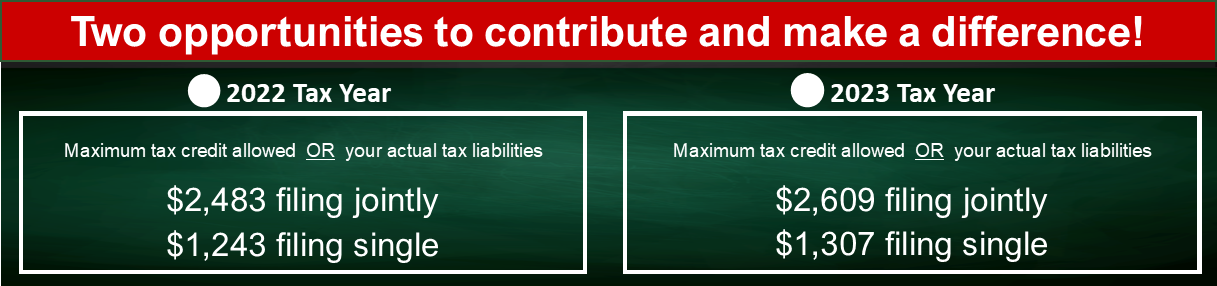

See the chart below for the total dollar amount allowed for each year:

HOW TO CONTRIBUTE:

Step 1: Identity how much is your Arizona state income tax liability. (If you receive a W2, check your last Pay-stub or your W2 slip for the amount of your State taxes).

Step 2: Fill out the online or the printable Individual donor form.

Step 3: For tax filing purposes, the total amount is broken down into two (2) categories: (Individual Original & Individual Switcher tax credit).

If your income tax is above the maximum amount allowed for filing jointly or filing singly, then do the following:

- Select the dollar amount for your filing status (married/jointly or single) under the Individual Original tax credit and repeat the steps under the Switcher section.

If your income tax is less than the maximum amount allowed for filing jointly or filing singly, then do the following:

- Select "Other Amount" under the Individual Original tax credit and type the total amount of your tax credit contribution, ONLY.

Step 4: List your recommended student(s)/ school (optional) and complete your payment.

Step 5: Once STO4KIDZ receives your payment, we will email or mail you an official receipt with instructions on how to claim your tax credit and the tax forms to use when filing your state taxes.

When filing your personal taxes, you can claim the tax credit by using Arizona forms 301 and 323 along with state income tax forms. However, if you contribute to the Switcher program, you also need to file a 348 form. Also, use AZ Schedule A to claim the federal deduction. All these forms and more can be found at azdor.gov.

Arizona Tax Forms:

Form 301 (Tax Credit Summary) & Instruction

Form 323 (Original Tax Credit) & Instruction